Unlocking Rural Livingwith USDA Loans

No SSN required. Zero Impact to credit.

Your Information is never sold.

Speed

A Quick and Simple Process: Starting your USDA journey can be a breeze at Synergy One Lending.

Ease

A Seamless USDA Loan Application: Straightforward and tailored to your unique needs.

Expertise

Expert Guidance Every Step of the Way: Our team supports you throughout your USDA Loan journey

USDA Loans Open the Door to Affordable Homeownership in Charming Rural Locations

Imagine it: fresh air, open spaces, and a home you can truly call your own.

These special loans come with attractive features like zero down payment and low-interest rates, making rural living more accessible than ever.

Think you might qualify? Synergy One Lending can quickly help guide you through the process. Click below to see if a USDA loan can unlock your dream of rural homeownership!

No SSN required. Zero Impact to credit.

Your Information is never sold.

Securing a USDA Loan is a Straightforward Process

First, we’ll confirm that your dream home is located in a USDA-eligible rural area. Then, as a USDA-approved lender, Synergy One Lending will assess your financial situation – credit score, income, and debt-to-income ratio – to get you pre-approved.

With pre-approval in hand, you can confidently search for the perfect rural property that meets USDA requirements and fits your budget. Once you’ve found your dream home, our team will guide you through the closing process, ensuring a smooth transition and helping you unlock the keys to your new rural paradise.

Ready to embrace country living? Click below to see if you qualify for a USDA loan and get started on your homeownership journey today!

No SSN required. Zero Impact to credit.

Your Information is never sold.

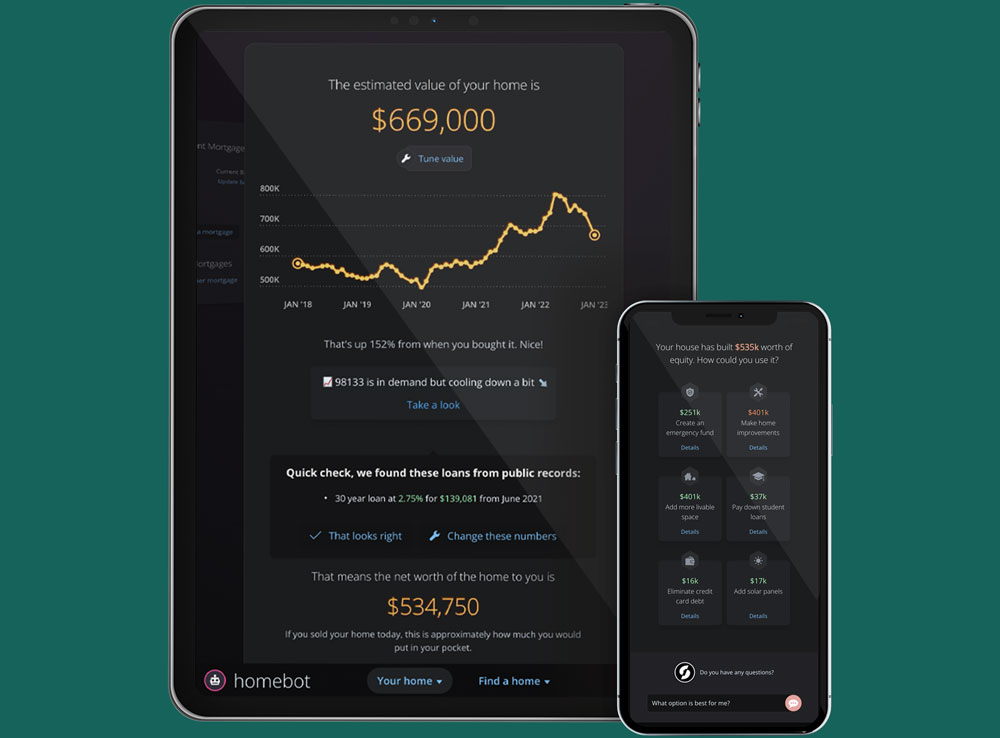

Chat With An Expert

Our USDA Loan experts are available to answer all your mortgage questions.